If you’re just stepping into the realm of O Level/IGCSE Accounting, understanding the terms “debit” and “credit” is a fundamental requirement. Luckily, we here at Out-Class have created this quick reference guide to help you out!

What is Debit and Credit in Accounting?

In accounting, every transaction has two parts: a debit and a credit.

-

A debit usually appears on the left side of an account ledger

- A credit usually appears on the right side.

Let us illustrate the meaning of these terms through an example:

Difference Between Debit and Credit in Accounting Example

Imagine your business purchases a new laptop for PKR 50,000. In this scenario, you would debit the equipment account by PKR 50,000, reflecting the acquisition of a new asset. Simultaneously, you would credit your cash account by PKR 50,000, showing a decrease in cash due to the purchase.

How are Debits and Credits Used in Accounting?

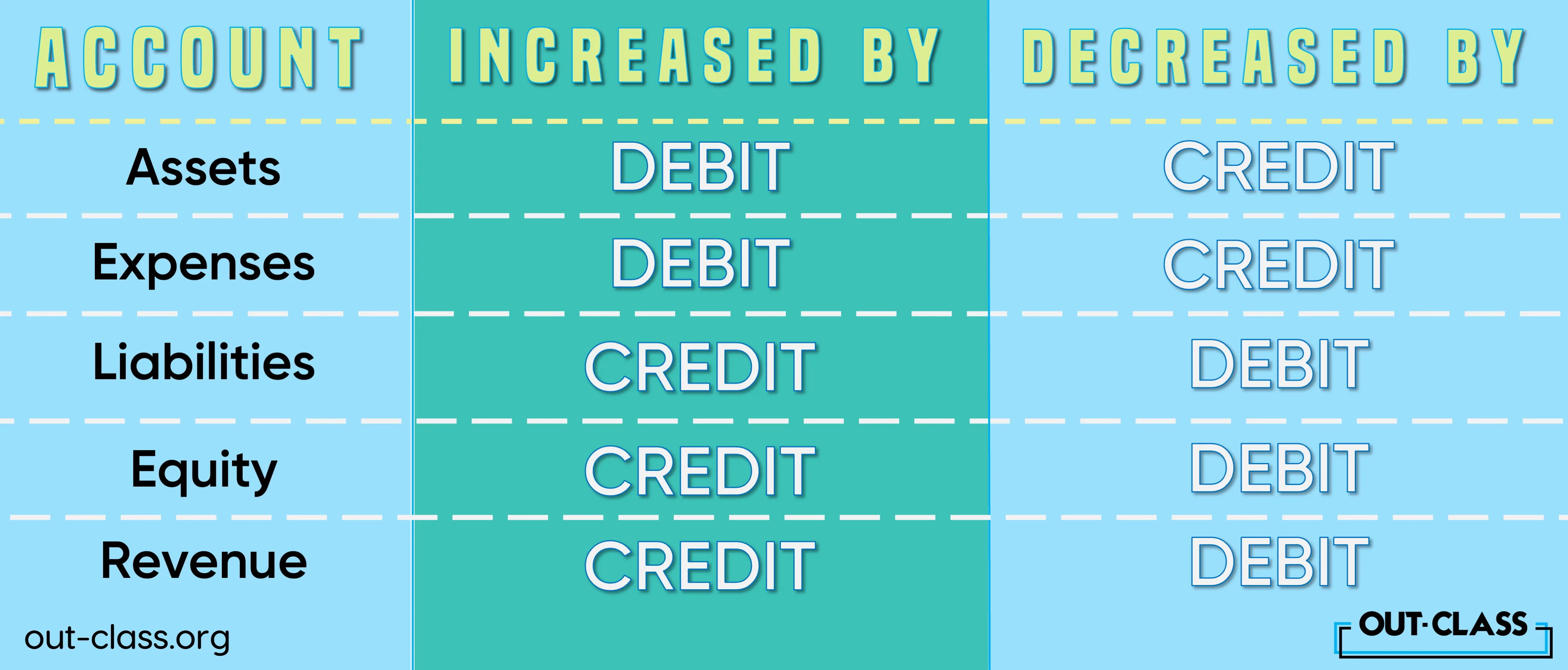

Debit and credit are used to record the financial transactions of a company. Debits typically increase assets and expense accounts. Conversely, credits decrease assets or expenses, increasing liabilities or equity.

GOLDEN RULE of Debit and Credit

For your “books to be balanced”, for every debit entry, there must be a corresponding credit entry in your ledgers, as you saw in the earlier example.

Conclusion

In conclusion, understanding the debit and credit system is a stepping stone in mastering accounting. We hope this guide helped you understand the difference between debit and credit in accounting. If it was, check out our O Level/IGCSEAccounting crash course here if you want to get ahead of the competition and ace your exams!